Due to recent regulation changes, tax liens should not be reporting on your Equifax, Transunion or Experian credit report any longer. However, they may very well show up on various public record reports such as the popular LexisNexis.

BlogSperityCredit + Money

Topics: Credit + Money, Trending Stories, Top Blog Story

Differences between debt settlement, debt consolidation, financial counseling & credit restoration.

Debt Settlement - is an approach to debt reduction in which the consumer (or company on behalf of the consumer) and a creditor agree on a reduced balance that will be regarded as payment in full. During a negotiation period, all payments by the consumer are made to the debt settlement company, which typically withholds the payments in an escrow account until enough funds have been built up to begin the offering of a reduced amount to the creditor(s).

Topics: financial future, Credit + Money

Here are steps that you can take to protect your personal information from being abused.

Find out if your information may have been exposed.

You can do this by entering your last name and the last six digits of your Social Security number at Equifax's website. The site will disclose if you if you've been affected by the data breach.

Consider enrolling for a free year of credit monitoring.

U.S. Equifax consumers are eligible for year of free credit monitoring and other services regardless of whether or no your information was exposed.

Be sure to monitor your accounts for any unusual activity.

Accounts on your credit reports that you didn't open, incorrect personal information on your credit reports, and credit inquiries from companies that you've never contacted. These are all potential signs of fraud or identity theft.

Consider placing a credit freeze.

Placing a credit freeze on your credit makes it more difficult for a thief to open a new account in your name. Remember that a credit freeze cannot prevent a thief from making changes to your existing accounts.

Consider setting a fraud alert.

This will require creditors to verify your identity before issuing a credit card, opening a new account or increasing a credit limit on an existing account. A fraud alert will not prevent a lender from opening credit in your name in the same way that a freeze does, but it will require lenders to take additional steps to verify your identity first.

Topics: financial future, Credit + Money

Avoid Buyer's Remorse with Smart Spending Habits

Practice Before You Pay (PBYP). I realize this is not going to make much sense at the beginning of this blog but trust us, by the end it will be crystal clear. PBYP is a simple habit to pick up, but it will revolutionize the way you spend money. Consider, for example, the next purchase you wish to make, by monthly payments—and don’t worry, the purpose of this blog post isn’t just to artfully dissuade you from going ahead and buying the item in question.

Topics: Credit + Money

What Not to Do When Applying for Credit Cards

Applying for a new credit card is a financial minefield to navigate without the right help. Just one misstep and the whole thing can literally blow your chances—and your credit—up! Fear not though, Sperity is here with a handy guide for avoiding potential credit hazards when applying for new credit. Here is the list of what NOT to do when applying for credit.

Topics: Credit + Money

Just How Much Is Your Debt Costing You Per Day

We all feel shackled by our loan debts. For each seemingly never ending burden that you’re judiciously paying off each month there must eventually be a light at the end of tunnel? Right? Want to predict your debt-free future? Would you like to know exactly when you’ll be debt-shackle free? Then you need to work out exactly how much your debt is costing you per day. Recognizing the effect debt has on your day-to-day expenses can be a real motivator to get yourself out of those shackles ahead of schedule. And all you need is this simple equation;

Topics: Credit + Money

Buying a home is a financial dream held by nearly everyone. As is the desire to stop paying dead-end rent and being at the mercy of your landlord; a yearning that most of us can relate to. But we all know the build-up to buying a house starts long before the moment you finally receive the keys to your own front door. It isn’t until most people start to consider turning that dream into a reality that they hit upon their first obstacle; their credit scores.

Topics: financial future, Credit + Money, Trending Stories

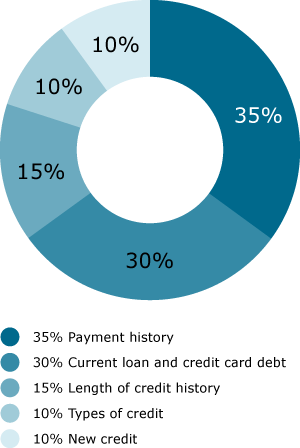

For some, it sits comfortably high in the 700s, while for others, it’s the financial skeleton in their closet they’d rather not discuss thank-you, but how exactly is it calculated? Well, before we examine that, it’s worth understanding what your credit score isn’t. It is not a reflection of the money you have saved in your bank account or the income you generate each week or month. Also, it is not a calculation based on your debt-to-income ratio or your net worth either. And in this day and age, credit scores are possibly one of the few things you can count on that are in no way influenced by race, gender, age or religion.

Your credit score is actually a summary of just how well you can borrow money and then pay it back. A consistent ongoing measure of how you are managing your current debt situation. And ironically, you can only achieve a good credit score by being in a certain amount of debt. The important factors are that you’re paying off your accounts perfectly and not incurring any more debt.

Topics: Credit + Money

Tax Liens on Your Credit Report

Read MoreCredit + Money

How You Can Protect Your Credit Data

Here are steps that you can take to protect your personal information from being abused.

Find out if your information may have been exposed.

You can do this by entering your last name and the last six digits of your Social Security number at Equifax's website. The site will disclose if you if you've been affected by the data breach.

Consider enrolling for a free year of credit monitoring.

U.S. Equifax consumers are eligible for year of free credit monitoring and other services regardless of whether or no your information was exposed.

Be sure to monitor your accounts for any unusual activity.

Accounts on your credit reports that you didn't open, incorrect personal information on your credit reports, and credit inquiries from companies that you've never contacted. These are all potential signs of fraud or identity theft.

Consider placing a credit freeze.

Placing a credit freeze on your credit makes it more difficult for a thief to open a new account in your name. Remember that a credit freeze cannot prevent a thief from making changes to your existing accounts.

Consider setting a fraud alert.

This will require creditors to verify your identity before issuing a credit card, opening a new account or increasing a credit limit on an existing account. A fraud alert will not prevent a lender from opening credit in your name in the same way that a freeze does, but it will require lenders to take additional steps to verify your identity first.

Financial Future

How You Can Protect Your Credit Data

Here are steps that you can take to protect your personal information from being abused.

Find out if your information may have been exposed.

You can do this by entering your last name and the last six digits of your Social Security number at Equifax's website. The site will disclose if you if you've been affected by the data breach.

Consider enrolling for a free year of credit monitoring.

U.S. Equifax consumers are eligible for year of free credit monitoring and other services regardless of whether or no your information was exposed.

Be sure to monitor your accounts for any unusual activity.

Accounts on your credit reports that you didn't open, incorrect personal information on your credit reports, and credit inquiries from companies that you've never contacted. These are all potential signs of fraud or identity theft.

Consider placing a credit freeze.

Placing a credit freeze on your credit makes it more difficult for a thief to open a new account in your name. Remember that a credit freeze cannot prevent a thief from making changes to your existing accounts.

Consider setting a fraud alert.

This will require creditors to verify your identity before issuing a credit card, opening a new account or increasing a credit limit on an existing account. A fraud alert will not prevent a lender from opening credit in your name in the same way that a freeze does, but it will require lenders to take additional steps to verify your identity first.